Does Homeowners Insurance Cover Sewer Line and Septic System Repairs?

Homeowners insurance typically does not cover sewer line or septic system repairs, as these issues are often excluded from standard policies due to their association with wear and tear, lack of maintenance, or pre-existing conditions. Most standard homeowners’ policies cover damage to the home itself and personal property, but not the underlying systems like sewer lines or septic tanks, unless specifically included. This exclusion applies to damage caused by issues such as slow pipe deterioration, clogs from neglect, or problems that arise over time due to wear.

However, some insurance providers offer optional add-ons, such as “service line coverage” or “water backup coverage,” which can help protect against the cost of sewer line repairs and damage caused by backups. These endorsements provide additional financial protection if the damage results from a covered event, like a burst pipe or an accidental rupture.

For example, if tree roots damage a sewer line and cause a backup, a standard policy might not cover the repair. However, with service line coverage, repairs for this type of damage may be covered. Understanding the claims process is crucial for homeowners to ensure they receive the coverage they expect. In cases of sewer line or septic system issues, homeowners should contact their insurer promptly, document the damage, and understand the specific exclusions of their policy to prevent surprises during the claims process.

Sewer Line Coverage and Repairs

Homeowners insurance typically covers sewer line repairs only when the damage is sudden and accidental, such as damage caused by a burst pipe, a tree falling, or a storm-related event. However, it generally excludes issues like wear and tear, tree root intrusion, or neglect. To get repairs covered, homeowners must file a claim, provide documentation, and work with an adjuster to assess the damage. It is important to understand these exclusions and limitations, as damages from gradual issues like corrosion or clogs caused by neglect are not typically covered under standard homeowners insurance policies.

What Is Covered Under Homeowners Insurance for Sewer Lines?

Homeowners insurance typically covers sewer line damage caused by sudden and accidental events, such as a burst pipe, storm-related damage, or a tree falling on the sewer line. This includes damage caused by events like fire, explosion, or a falling object. Additionally, if you purchase an add-on like Service Line Coverage, it can protect against damage from corrosion, rust, freezing, tree root invasion, and even damage caused by vehicles. However, issues resulting from neglect, wear and tear, or gradual deterioration are typically excluded.

Events covered under homeowners’ insurance for sewer lines include:

- Burst pipes: Damage caused by a sudden rupture in the sewer line.

- Storm damage: Damage from flooding or strong winds that impacts the sewer line.

- Falling trees: If a tree falls and damages the sewer line.

- Service line coverage (if purchased): Covers damage from degradation (e.g., corrosion), freezing, tree roots, or even mechanical or electrical malfunctions.

Understanding these covered events, along with the exclusions, is vital for homeowners to ensure proper coverage for sewer line issues.

Common Causes of Sewer Line Damage Covered by Homeowners Insurance

Damage to sewer lines caused by sudden and accidental events, such as storms, tree root intrusion, or accidental breakage, is typically covered by homeowners’ insurance. This includes damage from severe weather, like flooding or heavy rain, that impacts the sewer line, as well as tree roots unexpectedly invading the pipes. Accidental breakage, such as sewer lines cracking due to ground shifting or construction activities, is also covered. Additionally, if freezing causes a sewer line to rupture, it may be included in the policy.

Covered causes of sewer line damage include:

- Storm-related damage: Severe weather conditions, such as flooding or heavy rains, that damage the sewer line.

- Tree root intrusion: Damage caused by tree roots unexpectedly invading the sewer lines.

- Accidental breakage: A sewer line breaking due to unforeseen events, such as ground shifting or construction accidents.

- Sudden freezing: Damage from a sudden freeze that causes the sewer line to crack or rupture.

While these types of damage are typically covered, issues like wear and tear, neglect, or gradual deterioration are generally excluded. It is important for homeowners to understand their policy’s exclusions and consider additional coverage for risks like tree roots or sewer backups.

What Is the Process for Repairing or Replacing Sewer Lines Under Homeowners’ Insurance?

The process for repairing or replacing sewer lines under homeowners’ insurance involves filing a claim, working with an adjuster to assess the damage, and coordinating with contractors for the repairs. If the damage is covered under the policy, the insurer will help pay for repairs, but homeowners may need to meet certain requirements, such as paying a deductible.

Here is the entire process of repairing or replacing sewer lines under homeowners’ insurance:

- Contact the insurance provider: Notify the insurer as soon as damage to the sewer line is discovered.

- Document the damage: Take photos and videos of the damage to provide proof.

- Submit a claim: File a formal claim with all necessary documentation, including photos and repair estimates.

- Insurance adjuster assessment: An adjuster will evaluate the damage and determine whether the claim is covered under the policy.

- Approval and repair coordination: If the claim is approved, coordinate with contractors to perform the repairs. The insurer will cover the cost within policy limits, minus the deductible.

Understanding the claims process and working closely with the insurer helps ensure that sewer line repairs are handled efficiently and within coverage limits.

When Does Home Insurance Cover Sewer Line Damage?

Home insurance typically covers sewer line damage when it arises from a sudden, accidental event or a covered peril, such as a burst pipe, storm-related flooding, or a tree falling on the sewer line. Homeowners should review their policy to understand which perils are included and when they are covered.

Scenarios when home insurance will cover sewer line damage are:

- Sudden ruptures: If a sewer line bursts unexpectedly due to a covered peril like freezing weather or shifting ground.

- Storm damage: Damage caused by storms, flooding, or other natural disasters that affects the sewer line.

- Accidental breakage: If an accident, such as a construction mishap or a heavy vehicle impact, causes damage to the sewer line.

However, damage from neglect, wear and tear, gradual deterioration, or tree root invasion is generally excluded unless additional endorsements, such as service line coverage, are added to the policy.

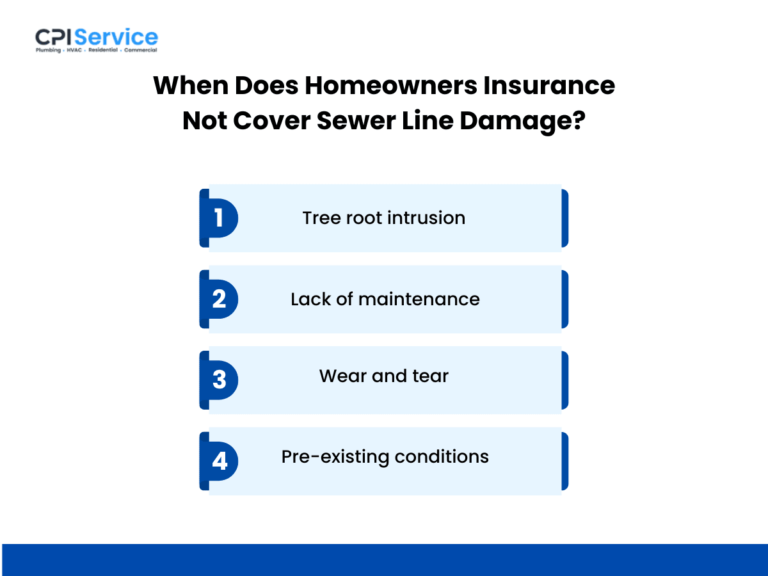

When Does Homeowners Insurance Not Cover Sewer Line Damage?

Home insurance does not cover sewer line damage when it results from neglect, wear and tear, or gradual deterioration. Issues such as tree root intrusion, lack of maintenance, or pre-existing conditions are also excluded. Most policies specifically exclude damage caused by these factors, as they are considered preventable or ongoing problems, rather than sudden, accidental events.

Common Exclusions for Sewer Line Damage

Sewer line damage is typically excluded from homeowners’ insurance when it results from issues that are preventable or gradual, such as tree root intrusion, lack of maintenance, or natural wear and tear. Since these problems develop over time and are not considered sudden or accidental, they are generally not covered under standard policies.

Common exclusions for sewer line damage under homeowners’ insurance are:

- Tree root intrusion: Damage caused by tree roots growing into and blocking or breaking the sewer line.

- Lack of maintenance: Problems resulting from neglect, such as clogs or corrosion that accumulate over time.

- Wear and tear: Deterioration or damage from the natural aging of pipes or sewer lines.

- Pre-existing conditions: Issues that existed before the policy was purchased, such as old or weakened pipes.

Homeowners may need to consider additional coverage options, like service line endorsements, to protect against these exclusions.

Why Tree Roots, Floods, and Negligence Are Not Covered in Homeowners Insurance?

Tree roots, flooding, and negligence are not covered by homeowners’ insurance because they are seen as preventable or gradual issues, rather than sudden and accidental occurrences. For example, tree roots that invade sewer lines over time, causing blockages or breaks, are typically excluded from coverage. Similarly, flood-related damage to sewer lines is often excluded unless additional flood insurance is in place. Negligence, such as failing to maintain or address issues with the sewer system, also falls outside the scope of standard coverage, as it is considered a preventable problem.

How Wear and Tear, Maintenance Issues, and Pre-Existing Problems Affect Coverage?

Homeowners insurance does not cover wear and tear, maintenance issues, or pre-existing problems because these are considered ongoing, preventable issues rather than sudden or accidental events. Damage caused by the natural aging of pipes, such as corrosion, rust, or deterioration, is excluded from coverage, as these issues develop over time. Similarly, problems stemming from poor maintenance, like clogged pipes or leaks due to neglect, are not covered since they could have been addressed with proper upkeep. Additionally, pre-existing conditions, such as old or weakened pipes, are excluded because they existed before the policy was purchased and are not considered sudden damage.

What Homeowners Can Do to Ensure Coverage for Sewer Line Issues?

To ensure coverage for sewer line issues, homeowners should take proactive steps, such as maintaining their sewer system and reviewing their insurance policy for specific coverage and exclusions. Adding optional endorsements like service line coverage or water backup coverage can help protect against damage that might otherwise be excluded under a standard policy. Regular inspections, addressing tree root growth, and keeping the system in good condition are key practices that can prevent damage. Additionally, homeowners should keep documentation of any maintenance or repairs performed, as this can be crucial when filing a claim to ensure coverage.

Service Line Coverage and Endorsements

Homeowners can protect themselves from the high costs of repairing or replacing sewer lines, water pipes, and other underground utility lines by adding service line coverage and endorsements to their insurance policy. These optional add-ons cover damage from events like tree root invasion, freezing, or accidental breaks, which are typically excluded under standard policies. Without this coverage, homeowners would face the full cost of repairs, which can be significant. It is important to check whether service line coverage is available through your insurer and consider adding it to safeguard your home’s essential service lines.

What Is Service Line Coverage for Sewer Lines and Other Utility Lines?

Service line coverage is an optional endorsement that can be added to a homeowner’s insurance policy to protect against the cost of repairs or replacements for underground utility lines, such as sewer lines, water pipes, and gas lines. These lines are typically excluded from standard homeowners’ insurance policies, meaning homeowners are responsible for any damage that occurs to them. Service line coverage helps pay for repairs when these systems are damaged due to sudden, accidental events, such as a burst pipe, shifting ground, or external factors like tree root intrusion.

It also covers damages from events like freezing or accidents, such as a vehicle striking the utility lines. Without this coverage, homeowners may face significant out-of-pocket expenses for repairs, which can often be expensive and disruptive. Since service line coverage is not typically included in a basic homeowners policy, homeowners should check with their insurer to see if it can be added as an endorsement.

How to Add Service Line Coverage to Your Homeowners Insurance Policy?

To add service line coverage to your homeowners’ insurance policy, homeowners must contact their insurance provider and request the optional endorsement. This coverage is not typically included in standard policies, so it needs to be specifically added. While the process is straightforward, it’s important to review the coverage details and any associated costs with your insurer.

Steps to add service line coverage to your homeowners’ insurance policy:

- Contact your insurance provider: Reach out to your insurer to inquire about adding service line coverage to your existing policy.

- Review coverage options: Discuss the specific coverage options available, including what types of damage will be covered (such as tree root intrusion, freezing, or accidental breaks).

- Understand the cost: Get a clear understanding of the premium increase and any deductible that may apply.

- Add the endorsement: Once you have reviewed and agreed on the terms, your insurer will add the service line coverage to your policy.

By adding this coverage, homeowners can safeguard against the potentially high cost of repairing or replacing underground utility lines.

What Does Service Line Coverage Include and Exclude?

Service line coverage protects homeowners against the cost of repairing or replacing underground utility lines, such as sewer lines, water pipes, and gas lines. It typically includes damage caused by sudden, accidental events like tree root intrusion, freezing, or accidental breaks. Additionally, it covers the cost of excavation and labor, which can be a significant part of the repair process. However, service line coverage does not include damage from wear and tear, neglect, or pre-existing conditions. It also generally excludes damage caused by natural disasters, such as earthquakes or floods, unless additional coverage is specifically added to the policy.

Service Line Coverage Inclusions:

- Tree root intrusion: Damage caused by tree roots growing into the sewer or water pipes.

- Freezing: Pipes damaged by sudden freezing temperatures.

- Accidental breaks: Damage from unintentional events like a construction accident.

- Repair and labor costs: Includes the cost of digging and repairing the damaged lines.

Service Line Coverage Exclusions:

- Wear and tear: Damage from gradual deterioration over time.

- Neglect: Issues resulting from a lack of proper maintenance.

- Pre-existing conditions: Problems that existed before the policy was purchased.

- Natural disasters: Damage caused by earthquakes or floods (unless additional coverage is added).

Septic System Coverage

Septic system coverage is generally not included in standard homeowners insurance policies, but can be added as an optional endorsement. This coverage helps pay for repairs or replacement of a septic system when it fails due to unexpected issues, such as damage from a sudden septic tank collapse or an accidental malfunction. Without this coverage, homeowners are responsible for the high costs associated with septic system repairs, which can be expensive and disruptive. Homeowners should check with their insurer to see if septic system coverage can be added and review the specific terms and exclusions related to this coverage.

Does Homeowners Insurance Cover Septic Systems?

Homeowners insurance typically does not cover septic systems under standard policies. Issues like septic tank failures or clogs caused by neglect or wear and tear are usually excluded.

However, some insurers offer optional endorsements for septic system coverage, which can help protect against repair or replacement costs when the system fails unexpectedly. If this coverage is added, it may cover damage due to sudden accidents, such as a malfunction or a septic tank collapse. Homeowners should review their policy and consider adding this endorsement for extra protection.

How to Add Septic System Coverage to Your Homeowners Insurance Policy?

To add septic system coverage to your homeowners’ insurance policy, homeowners must contact their insurance provider and request the optional endorsement. Since septic system coverage is not typically included in a standard policy, it needs to be added separately. The process involves reviewing the coverage details with the insurer, understanding the cost, and determining the types of damage it will cover.

Here is how you can add septic system coverage to your homeowners’ insurance:

- Contact your insurance provider: Reach out to your insurer to inquire about adding septic system coverage to your policy.

- Review coverage options: Discuss the specifics of the coverage, including what types of damage, like septic tank collapse or accidental failure, will be covered.

- Understand the cost: Get clarity on the premium increase and any deductibles or coverage limits.

- Add the endorsement: Once agreed upon, your insurer will add the septic system coverage to your policy.

Adding this endorsement ensures that homeowners are financially protected against costly septic system repairs or replacements.

What Is Covered and Excluded in Septic System Failures?

Septic system coverage typically covers sudden and unexpected failures, such as a septic tank collapse or an accidental malfunction, but excludes issues caused by neglect, wear and tear, or lack of maintenance. This means that if a septic tank suddenly fails due to an unforeseen issue, the costs of repairs or replacement are covered, including labor and materials. However, damage from gradual deterioration, like rust or corrosion, or issues resulting from improper maintenance, such as clogged pipes from neglect, are generally excluded from coverage.

Coverage typically includes:

- Septic tank collapse: Sudden failure or collapse of the septic tank.

- Accidental malfunction: Unforeseen malfunctions in the septic system.

- Repair costs: Costs for labor and materials to repair or replace the septic system.

Exclusions typically include:

- Neglect: Damage from lack of proper maintenance.

- Wear and tear: Gradual deterioration of the system.

- Pre-existing conditions: Issues that existed before the policy was purchased.

How to Submit a Claim for Sewer Line Damage?

To submit a claim for sewer line damage, homeowners must contact their insurance provider, document the damage, and provide the necessary evidence for assessment. The process begins by notifying the insurer, followed by gathering supporting materials such as photos, videos, and repair estimates. Once the claim is filed, an adjuster will evaluate the damage to determine if it falls under the policy’s coverage. If approved, the homeowner will receive compensation for the repair costs, but may be required to pay a deductible. It is important to follow all steps carefully and submit the claim promptly to avoid delays.

Step-by-Step Guide for Filing a Sewer Line Damage Claim

Filing a sewer line damage claim involves several key steps to ensure that the process goes smoothly and homeowners receive the compensation they are entitled to. Below is a simple guide to help homeowners navigate the claims process.

- Contact your insurance provider: Notify your insurer as soon as possible to inform them of the damage.

- Document the damage: Take clear photos and videos of the damage to the sewer line and surrounding areas.

- Get a repair estimate: Obtain an estimate from a licensed plumber or contractor for the cost of repairs.

- File the claim: Submit the damage documentation, repair estimates, and any other required paperwork to your insurer.

- Work with the adjuster: An insurance adjuster will assess the damage and determine whether the claim is covered under the policy.

By following these steps, homeowners can ensure their claim is processed efficiently and that they receive the coverage they expect.

What Documentation Is Needed for a Claim?

When filing a claim for sewer line damage, homeowners must provide specific documentation to support their claim. This helps the insurance provider assess the damage and determine whether it falls under the coverage terms.

Required documentation needed while filing a claim for sewer line damage typically includes:

- Photos and videos: Clear images or video footage of the damaged sewer line and the surrounding area.

- Repair estimates: Written estimates from licensed plumbers or contractors for the cost of repairs.

- Claim forms: Any forms required by the insurance provider, which may be submitted online or in writing.

- Maintenance records: Documentation showing any past maintenance or repairs done to the sewer system, if available.

- Proof of damage: Additional proof that shows the damage was sudden and accidental (e.g., photos of the event, such as a tree falling).

Providing all necessary documentation will help ensure the claim is processed quickly and accurately.

How to Work with an Insurance Adjuster?

The process of working with an insurance adjuster involves providing necessary documentation, coordinating inspections, and understanding the adjuster’s assessment to ensure timely and accurate claims processing. The adjuster will evaluate the sewer line damage, verify if it is covered under the policy, and determine the reimbursement amount. Homeowners must be prepared to share photos, repair estimates, and maintenance records, and should allow the adjuster to inspect the damage in person to ensure that all relevant factors are considered.

Below are the steps for working with an insurance adjuster:

- Provide documentation: Submit photos, videos, repair estimates, and maintenance records to support the claim.

- Coordinate the inspection: Ensure the insurance adjuster can inspect the damage and answer any questions about the incident.

- Understand the assessment: Ask the adjuster for a clear explanation of the coverage and reimbursement process.

- Follow up regularly: Stay in touch to check the status of the claim and provide any additional information requested.

By staying organized and responsive, homeowners can help ensure a smooth claims process.

How to Prevent Sewer Line Damage?

Preventing sewer line damage involves regular maintenance, proactive inspections, and taking steps to protect the system from common causes of damage. By addressing potential issues before they become major problems, homeowners can avoid costly repairs and extend the life of their sewer lines. Preventive measures include maintaining the integrity of the pipes, ensuring proper disposal of waste, and regularly clearing any blockages that may cause damage over time.

Key preventive actions to avoid sewer line damage include:

- Regular inspections: Schedule professional inspections to detect early signs of damage or wear, such as cracks or corrosion.

- Tree root management: Regularly trim tree roots near sewer lines to prevent root intrusion, which can cause blockages or pipe breaks.

- Proper waste disposal: Avoid flushing grease, oils, or non-biodegradable items down the drain, as these can cause clogs or damage to the sewer system.

- Clearing blockages: Use DIY methods like plunging or using a drain snake to clear minor blockages. For more stubborn clogs, call a plumber before the blockage worsens and potentially causes pipe damage.

- Pipe insulation: Insulate pipes to protect them from freezing temperatures, which can cause cracks and bursts.

By following these steps, homeowners can help minimize the risk of sewer line damage and reduce the need for costly repairs.

When to Call a Professional Plumber?

Homeowners should call a professional plumber when plumbing issues persist despite DIY efforts like using a plunger, drain snake, or chemical drain cleaners. While DIY methods may resolve minor clogs, problems such as severe blockages, persistent slow drains, or sewage backups require the expertise and specialized equipment of a licensed plumber. Recognizing when an issue exceeds basic repairs can help prevent further damage and save on costly future repairs.

Signs it is time to call a professional plumber:

- Persistent clogs: If plunging or using a drain snake does not clear the blockage, it may be time to call a plumber for a more thorough inspection.

- Slow draining: Consistent slow drainage in multiple areas of the home could indicate a deeper issue within the sewer line.

- Gurgling sounds: Gurgling sounds from the drains or toilet may signal a blockage in the sewer line or an issue with the venting system.

- Sewage backups: If sewage is backing up into your home, it is essential to call a plumber immediately to avoid health hazards and further damage.

- Foul odors: Strong, unpleasant odors near drains or in the yard could indicate a sewer line problem that needs professional attention.

If you notice any of these issues, a trusted, certified plumbing service can provide reliable sewer line repair and replacement. Experts offer comprehensive services, including sewer line inspections, trenchless sewer line replacement, drain cleaning, and emergency plumbing solutions. With a commitment to quality, these services ensure your plumbing system operates efficiently, saving you time and money on costly repairs down the road.

Alex Hamilton

Alex Hamilton is the owner of CPI Service, a trusted provider of plumbing and HVAC solutions. With over 35+ years of hands-on experience in the industry, He brings deep technical expertise and a proven track record in delivering reliable installation, maintenance, and repair services. His leadership ensures that CPI Service consistently upholds the highest standards of quality, safety, and customer satisfaction.